Preparing to buy your first rental property can be exciting, but it can also be overwhelming. There is a ton to learn, and you'll be learning those lessons with real money on the line.

That's why we recommend keeping your first property as easy is possible. You shouldn't learn to swim by jumping into violent Class 5 rapids and for similar reasons, you shouldn't start your rental property business by buying a 20-unit fixer upper that "has potential". Your returns may be more modest with this first property, but this approach will give you a chance to grow your comfort level, understand the expenses involved, and test out the team of professionals you will work with.

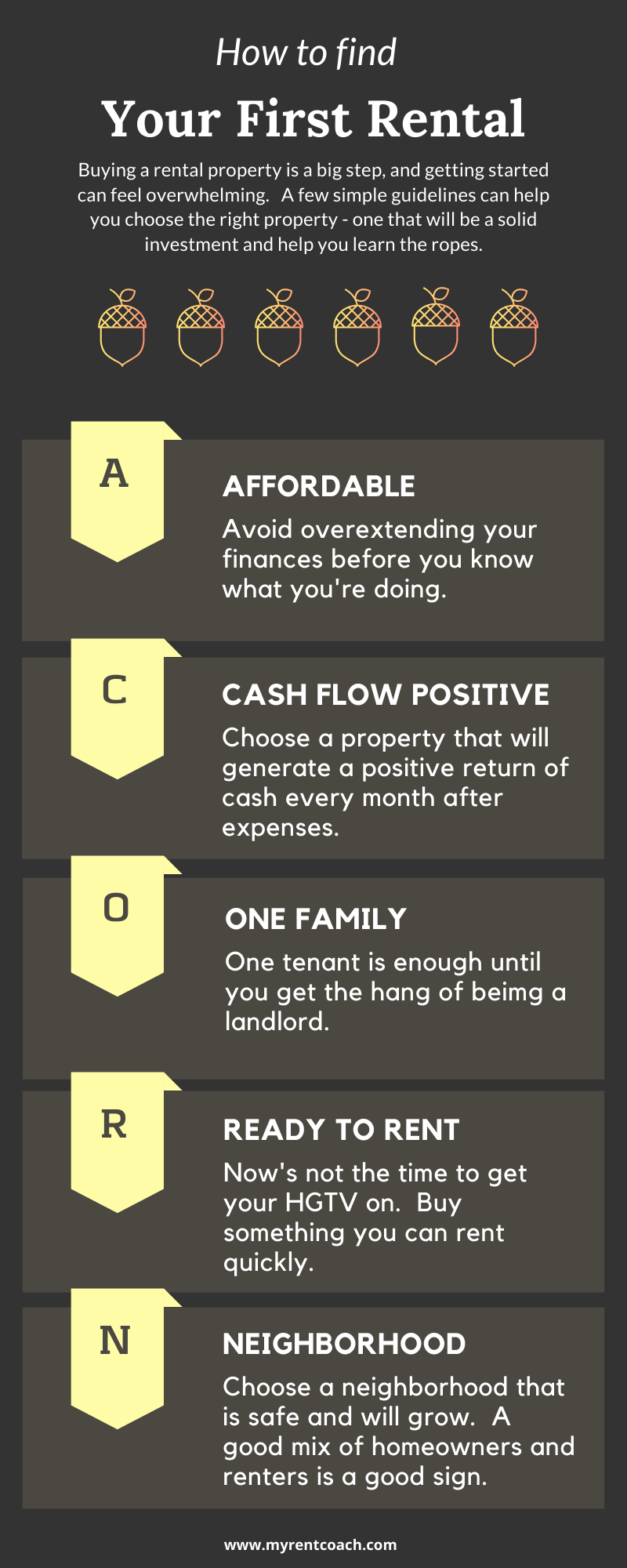

If you think of this initial effort as planting a seed, you will understand our thinking in naming this approach the ACORN method (well, that and the acronym worked) - a simple mental shortcut to help you quickly evaluate the properties you find on the market.

Affordable

You may be eager to get into the game, but keep in mind that a rental property comes with regular montly expenses - plus a mortgage if you're financing the purchase. In addition, as a first timer, you may not have a complete mental picture of all of the expenses involved to own and maintain your property. Pick a property that you can afford to make the payments on comfortably - even before the rent checks start coming in - and be sure to evaluate your cash reserve needs before making a purchase. This small initial success will put you in a position to be more aggressive in the future.

Cash Flow Positive

Time to crunch some numbers. Review your expected expenses to be sure your rental property will not be in the red. A rough rule of thumb is to look for properties you can rent for 1% of the purchase price. This means your $130,000 property should bring in $1300/month or more. Don't know what your property might rent for? This is why we built My Rent Coach in the first place - to help you estimate rental income with confidence!

One Family

Multifamily properties can offer excellent ROI opportunities, but remember - you're not ready for Class 5 rapids yet. One Family properties like Single Family residences, condos, or townhouses will simplify your startup. Only one tenant to find. Only one rent to collect. Only one water heater to fix. A solid starting place, so you can concentrate on a solid foundation for your business.

Ready to Rent

I know - that place with the boarded up windows, exposed electrical wires, and suspicious mound of dirt in the backyard could be the steal of a lifetime if you could just get it fixed up. But you're concentrating on getting started, not auditioning for your own HGTV show. Look for a property that is already in good shape, with little to no work required before finding a tenant and collecting rent.

Neighborhood

Location is everything in real estate, and that is no different for rental properties. Think through the neighborhoods available to you carefully. Is it a transformative time for any of those neighborhoods? Maybe a new mass transit line is planned nearby, or maybe new big employer is breaking ground a couple of miles up the road.Ultimately you want an area that will appreciate, and an area you feel comfortable being in - especially if you won’t use a property manager.

One useful and common way to frame your thinking about neighborhoods is to classify then as a Class A, Class B, or Class C neighborhood.

Class A neighborhoods are the most desirable (and expensive). They will have great schools, great restaurants, be walkable and be inhabited by higher income families. Nearly 100% of the homes in a Class A neighborhood will be owner occupied. The high entry costs of these neighborhoods make it very dificult to find a cash flow positive rental property.

With Class B neighborhoods on the other hand, you will find many more opportunities for a good rental property fit - this is where you should spend most of your time for a first rental property. These neighborhoods may have slighly older homes - 15-30 years old for example - and will be home to more blue collar workers. There will also be a mix of renters and homeowners. I like to look for a ratio of 30% renters / 70% homeowners, or thereabouts, to identify the best combination of cash flow vs. appreciation upside.

Lastly, Class C neighborhoods are not for the feint of heart and not for the first time landlord. These neighborhoods will feature old and possibly delapidated properties, poor schools, and higher levels of crime. They are also characterized by very low rates of home ownership.

You may have noticed a common theme in distinguishing between different neighborhood classes - home ownership ratios. In a future post, I will provide tools and techniques to identify these neighborhoods using data.